CoreWeave’s Projected Shareholder Dilution in 2026

Are they priced for perfection?

There are two key factors impacting CoreWeave Shareholder Dilution in 2026. The main issue is that they are reaching the limits of their net leverage coverage ratio, and that they will be forced to issue stock in order to remain under a net coverage ration of 7x. If they go over a net leverage coverage ratio of 7x, and they do not cure this with equity cures during the cure period, then they default on all outstanding loans. The second issue they have is that they do not have the cash to pay employees. This means that the primary method of paying for staff is issuing shares.

Equity Cures

Equity Cures are not an option for CoreWeave. They need them to survive. I have discussed the liquidity wall they are approaching in a previous article, but here I will be discussing a second reason they need them.

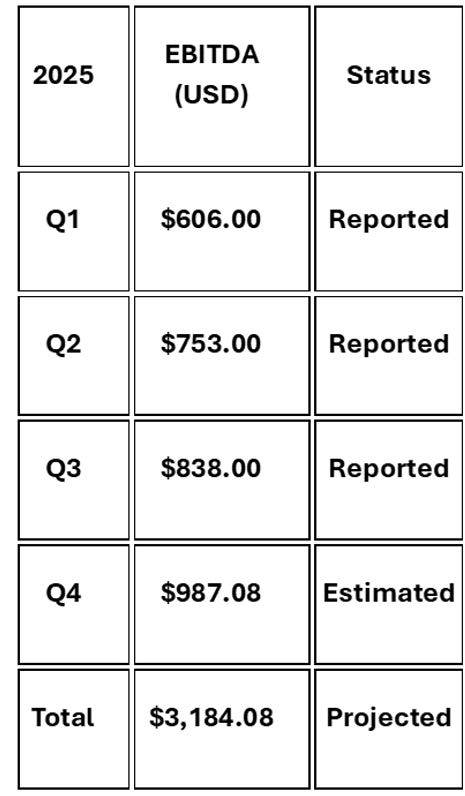

Organic Adjusted EBITDA

They have strict covenants in their lease that state the following in their most recent 10Q.

“As of the last day of each Fiscal Quarter, commencing with the Fiscal Quarter ending June 30, 2024, the Total Net Leverage Ratio of the Borrower and its Restricted Subsidiaries for the four Fiscal Quarter period then ended shall not exceed 6.00 to 1.00. Notwithstanding the foregoing, upon the consummation of a Material Acquisition during the term of this Agreement, upon written notice by the Borrower to the Administrative Agent at the consummation of such Material Acquisition of its intent to start an Increase Period, the Total Net Leverage Ratio may be greater than 6.00 to 1.00 for the first four Fiscal Quarters ending after the date of the consummation of such Material Acquisition (the “Increase Period”), but in no event shall the Total Net Leverage Ratio be greater than 7.00 to 1.00 as of the last day of any Fiscal Quarter (the “Permitted Leverage Increase”). After the Increase Period, the Total Net Leverage Ratio may not be greater than 6.00 to 1.00 as of the last day of each Fiscal Quarter until another permitted Increase Period occurs. There may be more than one Permitted Leverage Increase during the term of this Agreement, but only so long as there are two full Fiscal Quarters of compliance with the Total Net Leverage Ratio without giving effect to an Increase Period prior to the commencement of another Increase Period and no more than three Permitted Leverage Increases during the term of this Agreement.”

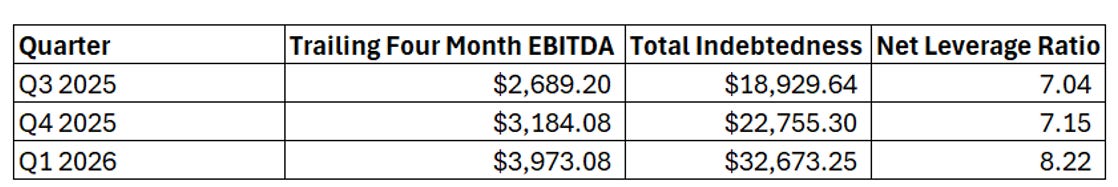

So, what does this mean? It means that CoreWeave’s debt cannot exceed 6x the last four trailing quarters of EBITA. Let’s dig into their last 4 quarters of EBITDA, and projected EBITDA for Q4 2025 – Q4 2026. For Q4 EBITDA I used the high end of management expectation on revenue multiplied times a 62% margin. The 62% margin is the highest quarterly margin they have reported in 2025. For Q1 I used the average analyst revenue projection and multiplied that by 62% and for Q2-4 I took the average analyst of full year revenue deducted Q1 and front loaded most of the revenue growth in Q2 to give CoreWeave as much credit as possible. Basically, I tried to provide an optimistic scenario for EBITDA in Q4 and throughout 2026.

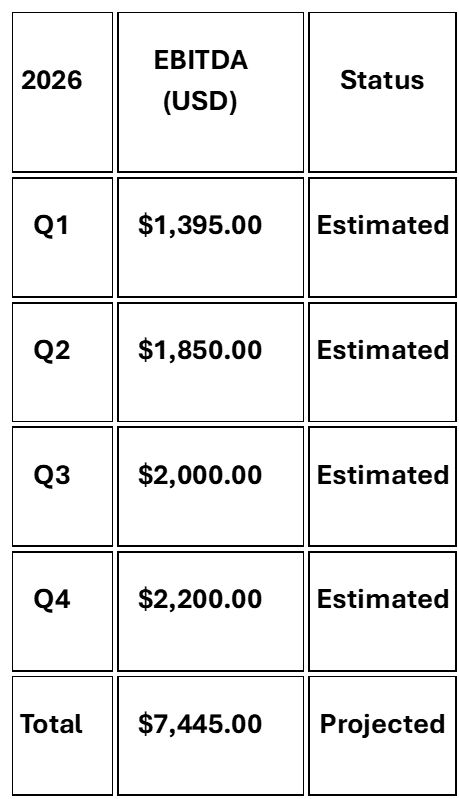

Consolidated Total Indebtedness

Now that we have an EBITDA number, we can need to calculate CoreWeave’s “Consolidated Total Indebtedness”. Here is how they define consolidated total indebtedness in the 10Q.

“The aggregate principal amount of Capital Lease Obligation, Purchase Money Obligations and unreimbursed drawings under letters of credit of the Borrower and its Restricted Subsidiaries outstanding on such date (provided that any unreimbursed amount under commercial letters of credit shall not be counted as Consolidated Total Indebtedness until five Business Days after such amount is drawn), plus (c) the aggregate principal amount of Indebtedness projected by the Borrower in good faith to be required to service the contracts that the Borrower elects to include in “Consolidated Adjusted EBITDA”

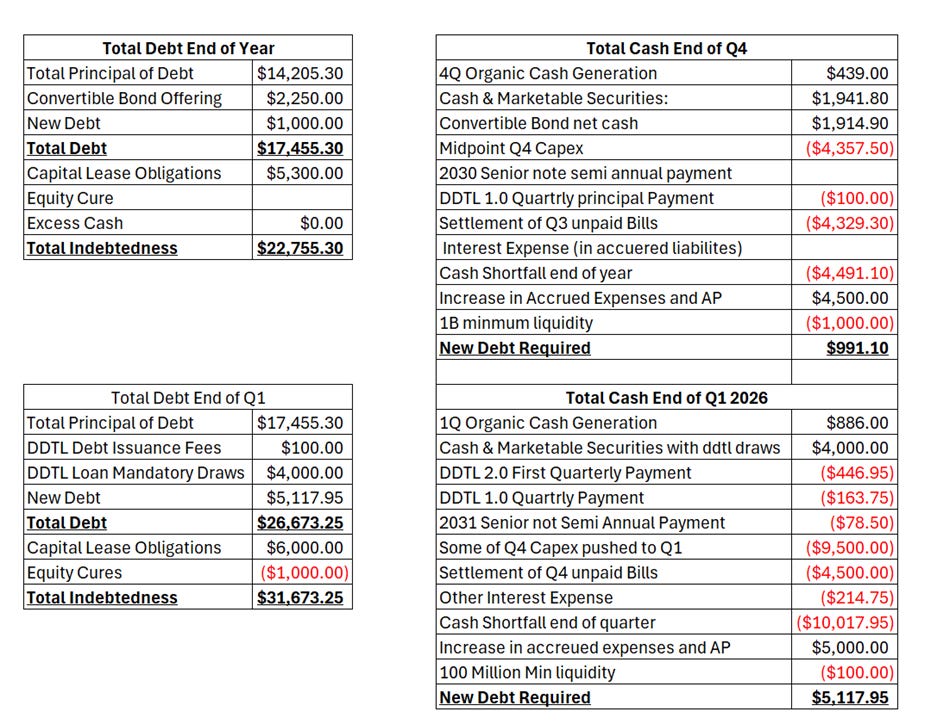

The total debt number from the 10Q is $14,205.30. We need to the go back and add in the discounted Capital Lease Obligations from the balance sheet of $345.472 current obligations, and $4,378.869 discounted non-current obligations. This brings total indebtedness as of September 30, 2025, to $18,929.64.

Okay, so let’s forecast future debt from there. For this I lean on information from the earnings calls, and the 10Q. Based on the Q2 earnings call total Capex for 2025 was supposed to be $20,000 - $23,000. In Q3 they dramatically adjusted this down to $12,000 - $14,000 and said the vast majority of 2025 Capex will now be done in Q1 2026. Given that they had spent $8,642.5 in Capex in 2025 by Q3 that means Q4 Capex will be between $5,357.50 and $3,357.50, and Q1 Capex will be at least $8,000 - $11,000. Given the immediate need for increased revenue and contract deadlines they really need to front load that capex in October- February. Here is what that looks like.

As you can see total Indebtedness really starts to snowball. I also want to note that CoreWeave’s Capital Lease Obligations are likely dramatically understated on this calculation. CoreScientific, CoreWeave’s largest landlord announced delivery of the Denton, Texas facility, a 260MW facility on December 29, 2025. This facility alone could add billions to CoreWeave’s lease obligations. They have over $10,200 billion in lease obligations, hitting the balance sheet in the next few years just from CoreScientific.

Net Leverage Coverage Ratio

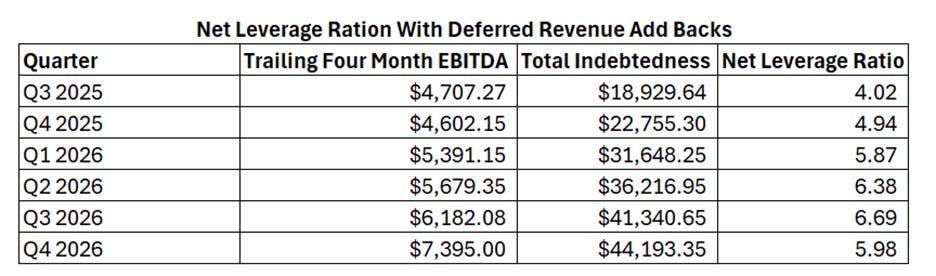

So now that we have all the numbers together, we can calculate the Net leverage Coverage Ratio. See the calculations below.

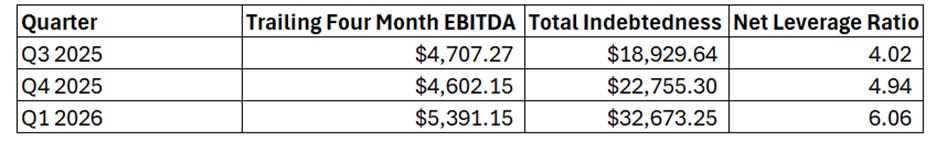

You might be wondering how they can have a net leverage ratio over 7.00x and not be in default of their loans. Well, the banks have allowed CoreWeave to pull deferred revenue forward and add it into current reported EBITDA. Here is what the table looks like when we add the deferred revenue back. We do not have all the data for Q4 2024, so I had estimate what deferred revenue was in that quarter, but I gave a generous assumption of $600 million.

As you can see the deferred revenue add backs are a big deal. So, what exactly are these addbacks? They are prepayments from customers for futures services to be provided by CoreWeave. Basically, CoreWeave got the cash up front to fund the data center, and the banks let them count this as current earnings. This is a double-edged sword though. If they cannot keep signed customers at the same pace, they will not be able to add back deferred revenue, and the Net Leverage Ratio will continue to rise. They likely breached the 6x leverage ratio in January which is why they had their loan agreements adjusted so that they could have unlimited equity cures. If they remain over a 6x leverage ratio for more than 4 consecutive quarters, they are in default. They are allowed four quarters between 6x-7x leverage because they technically “made an acquisition” of Monolith AI Limited in Q4 of over $50 million dollars.

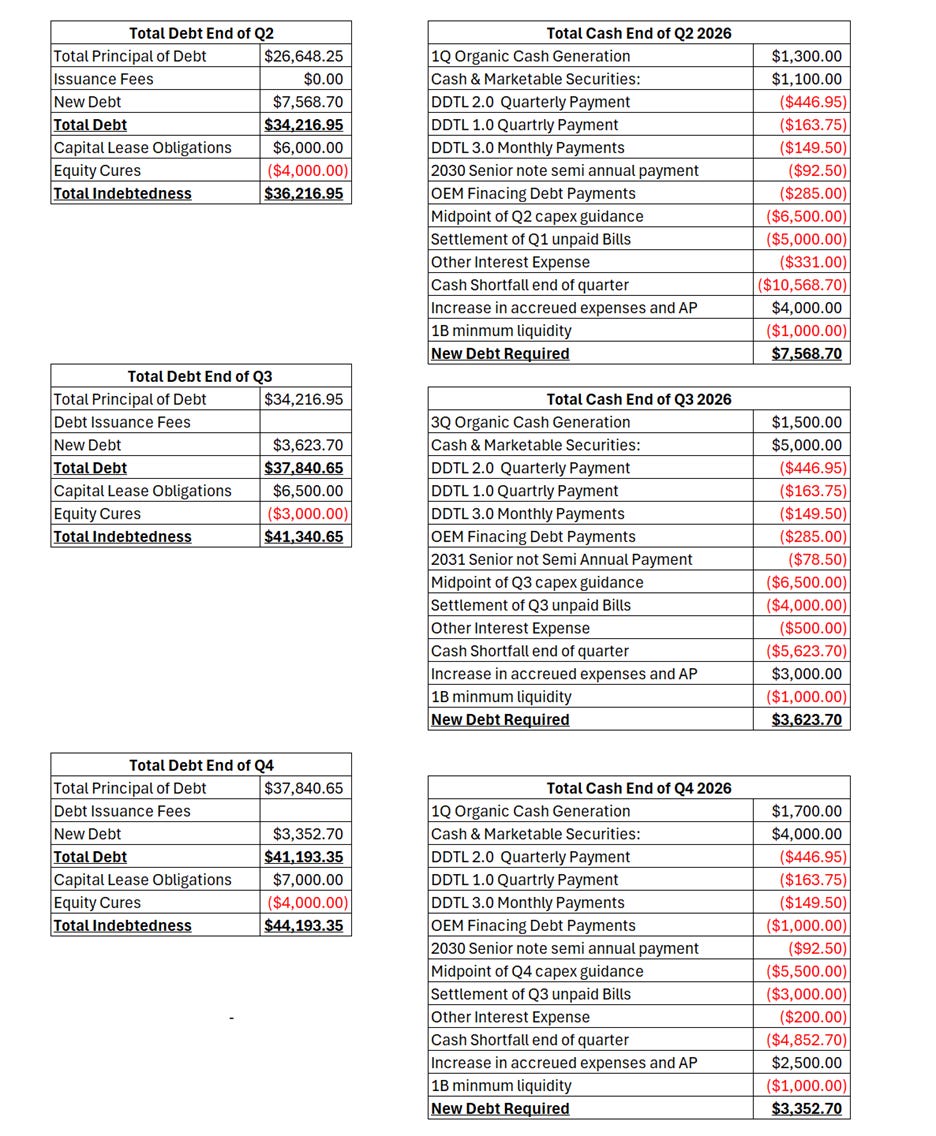

Total Spending Through 2026

So why does any of this matter if they are not in default? The reason it matters is because CoreWeave has to spend ~$4,500 in Capex in Q4, $9,500 in capex in Q1, and $18,500 in capex during the last 3 quarters of 2026. On top of this they have $2,250 in accrued equipment liabilities, and over $1,000 unpaid accounts payable. That is as grand total of $35,750 they need to spend just to get through 2026. Per my last article, they have $14,000 in total liquidity as of December 31, 2025, and most of that is debt. So, they need to raise additional $21,750 in debt and equity to get through 2026. Given that they have reached a limit on their borrowing capacity the next round of funding has to be equity. Not convertible bonds, not DDLT loans, not OEM financing, but equity.

Back to Equity Cures

So how much do they need to raise? In order to stay in the “safe zone” under a 6x net leverage ratio they need the following equity cures.

These equity cures provide just enough breathing room for CoreWeave to be able to raise the debt they need and keep funding capex. Here is how it impacts the net leverage ratio.

To keep the Net Leverage Ratio below 6x by the end of Q3 2026 CoreWeave needs to issue ~$12,000 in stock. At the price of $100 as of 1/18/2026 that is roughly 120 million shares. Outstanding shares are ~497 million. Shareholder dilution just from equity cures should be about 24-25%. This assumes everything goes as planned. A revenue miss of just 5% could lead to CoreWeave having to issue billions in shares. A 10% miss in revenue for the full year 2026 would almost certainly lead to a default. This is why hitting construction schedules is so critical, and capex spending is not an option.

Employee Stock Based Compensation

For CoreWeave cash in hand is far more important than share count. They need this cash to pay bills, pay capex, and lower their net liquidity ratio. For this reason, their primary method for paying staff is employee stock-based compensation.

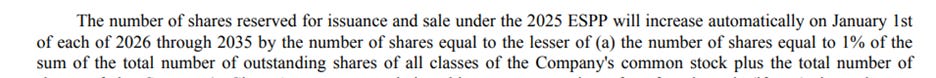

This compensation comes in two forms. One form is the Employees Stock Purchase Plan, which allows employees to purchase stock for 85% of fair market value. CoreWeave allows for the issuance of up to 1% of the total outstanding share to be printed for employees to purchase in any given year. This allotment is created January 1st of every year.

This means CoreWeave can issue up to 4.97 million in shares for employees to purchase at a discount.

The second form of stock-based compensation is the “Equity Incentive Plan”. From 2019-2024 they had a similar plan called the “2019 Stock Option Plan”. In that plan CoreWeave gave over 73.6 million shares to employees from 2019-2024. In March of 2025 they adopted the “2025 Plan”. A total of 50 million shares were initially reserved for 2025, and this number increased by 5% of outstanding shares on January 1, 2026. This brings the total number of shares CoreWeave can issue to employees to 74.85 million shares or about 15% of the existing shares outstanding.

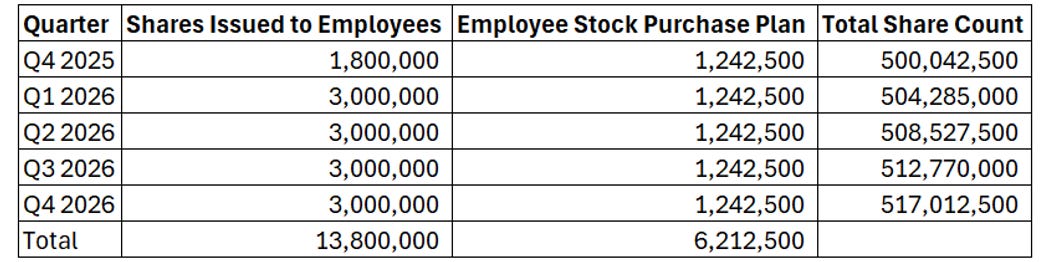

So how many shares have they issued

As of September 30th, 2025, 3.63 million shares were issued under this plan since March 31, 2025. They are issuing shares at a rate of about 600k shares /month. With the size of the company doubling next year this number should be expected to double. Stock based compensation should also be the largest in Q4 due to performance bonuses, and other targets. Having said that, let’s just use the 600k /Month number for Q4 and 1 million shares /month for 2026. This way we underestimate Q4, and we can increase our 2026 dilution estimate without overestimating too much. Here is how that works out full participation in the employee stock purchase plan.

This is a 20 million share increase in outstanding stock representing a 4% dilution of current shareholders. Keep in mind if the stock price falls, they will have to issue more shares to employees to retain talent.

Total Share Holder Dilution

So, what will the total shareholder dilution be in 2026? Based on these relatively conservative estimates if everything goes as planned, and the stock price stays at $100 CoreWeave will issue ~140 million new shares in 2026. This would be a 28.12% dilution at current prices. If the price of the stock falls and they must issue shares at $70 that would represent another 50 million in new shares printed. If the price falls to $40 they would have to sell over 300 million shares of the company to get through 2026.

Share price is not their only issue though. If they miss on revenue numbers by 10% and the share price stays at $100, they will need to issue 40 million more shares in 2026 to keep from defaulting on their debts. If share price falls and they miss revenue numbers, the death spiral could accelerate sharply.

CoreWeave is priced for perfection

Given the fragility of their situation, CoreWeave is priced for absolute perfection. Even one bad month could trigger a domino effect of negative consequences. With reports of increased DRAM prices and construction delays, CoreWeave may already be close to defaulting. This is the reason they made the amendment to DDLT 3.0 that allows for unlimited equity cures. It was not to provide breathing room; it was a lifeline.